Tax Treatment Of Non-Profit Entities In Nigeria

FOUNDATION

BACKGROUND

Pursuant to changes introduced to the tax regime under the Finance Act 2020 ("Finance Act"), the Federal Inland Revenue Service ("FIRS") recently issued two Information Circulars, both dated March 31, 2021 (the "Circulars"), detailing the rules that will, henceforth, guide its tax treatment of non-governmental organizations ("NGOs") in Nigeria. NGOs are not-for-profit associations of persons incorporated or registered in accordance with the applicable laws in Nigeria.

Prior to the enactment of the Finance Act 2020, profits or gains of entities engaged in ecclesiastical, charitable, or educational activities of a public character were exempt from tax, where such profits or gains were not derived from a trade or business carried on by such entities. The exemption was provided under section 23(1)(c) of the Companies Income Tax Act1 ("CITA"), section 26(1)(a) of the Capital Gains Tax Act2 ("CGTA"), and section 19(1) and paragraphs 1 and 13 of the Third Schedule to the Personal Income Tax Act3 ("PITA").

While it was clear that non-profit entities are only exempt from tax on incomes or gains which were not derived from activities of a commercial nature, there was no clarity about the activities that were of a "public character" for tax exemption purposes. The scope of the statutory tax exemption allowed for non-profit entities was thus not clear, and erroneously assumed to be absolute and unconditional by some taxable entities.

In order to clarify the intendment of the law and put it in proper perspective, the Finance Act provided a clear definition of the scope of the words "public character" within the meaning of the CITA. Accordingly, an organization or institution is of public character, if it is registered in accordance with relevant law in Nigeria; and does not distribute or share its profits in any manner to its members or promoters4.

This article provides a synopsis of the Circulars and analyses their implications for not-for-profit entities operating in Nigeria.

PROVISIONS OF THE CIRCULARS

The first Circular is titled: "Guidelines on the Tax Treatment of Non-Governmental Organisations" (the "Guidelines"). It provides clarification on the application of the provisions of the CITA, CGTA, PITA, and Value Added Tax Act5 ("VATA") to the income, operations, and activities of non-profit entities.

The Guidelines clarify that though NGOs enjoy statutory tax exemption on their incomes and gains, the tax exemption enjoyed is conditional and not absolute. The tax exemption will not apply where non-profit entities derive their incomes or gains from activities of a commercial nature. NGOs are also required to file their tax returns as at when due, ensure compliance with applicable tax procedures, and maintain accurate accounting records. In addition to the reiteration of the prohibition of distribution of the profits of entities of public character to their members, the Guidelines further clarify that the distribution of assets (whether in cash or in kind), such as gifting a vehicle or any asset for the personal use of the promoters or members of such entities, shall be construed as distribution of profits.

The Guidelines also clarify as tax-exempt, income derived by non-profit entities from members' subscription fees, donations, grants, zakat, offerings, tithes, funds realized from launchings, etc. However, where an NGO engages in any trade or business, or invests its assets in any institution, the profit or income derived therefrom (active or passive) is liable to tax appropriately. As such, incomes or profits liable to tax include proceeds from sale of goods or merchandise, provision of consultancy, professional or other services for a fee, and investment income, such as interest, rent, royalty, dividend or similar income.

As restated in the Guidelines, companies making donations to non-profit entities listed in the Fifth Schedule to the CITA, also enjoy tax relief pursuant to section 25 of the CITA, provided that: (a) the donation is made out of the company's profits for the relevant year of assessment; (b) the total donation made does not exceed 10% of the total profits of that company for the relevant year of assessment; and (c) such donation is not of capital nature, except where the donations are made to universities or other tertiary or research institutions or for any developmental purpose (which donation should not exceed 15% of the total profits of the company for the relevant year of assessment or 25% of the tax payable in line with the provisions of section 25A of the CITA).

The tax obligations of NGOs under the Guidelines include: (i) registration with FIRS for tax purposes; (ii) filing of annual tax returns under section 55(1) of the CITA6 and other relevant statutory provisions; (iii) liability to pay tax on all incomes and gains derived from commercial activities, or on incomes and gains not exclusively applied to the NGO's charitable object(s); (iv) registration with FIRS for listing under the Fifth Schedule to the CITA, for the purpose of eligibility to receive tax-deductible donations under section 25 of the CITA; (v) deduction at source, and remittance to the relevant tax authority, of applicable taxes, payable on the emoluments of its employees, directors, and officers (under the Pay-As-You-Earn regime).

Value Added Tax ("VAT") on goods purchased by NGOs, for use in humanitarian donor-funded projects is charged at zero rate under the VATA. However, it is noteworthy that NGOs are not exempt from VAT. As such, where they procure contracts or purchase goods that are not directly used in humanitarian donor-funded projects, VAT shall apply to the purchase or procurement at the prevailing rate. Likewise, any service procured or consumed by an NGO is liable to VAT at the prevailing rate, unless exempt from VAT under the VATA. NGOs are required to charge VAT on all taxable goods and services supplied and remit same to the FIRS as at when due. Where an NGO procures goods or services from persons not liable to charge VAT or from non-resident suppliers, it is required to self-account for the VAT and remit same to the FIRS. Under section 15 of the VATA, NGOs are required to file their VAT returns with the FIRS, not later than the 21st day of the month following that which the purchase or supply was made.

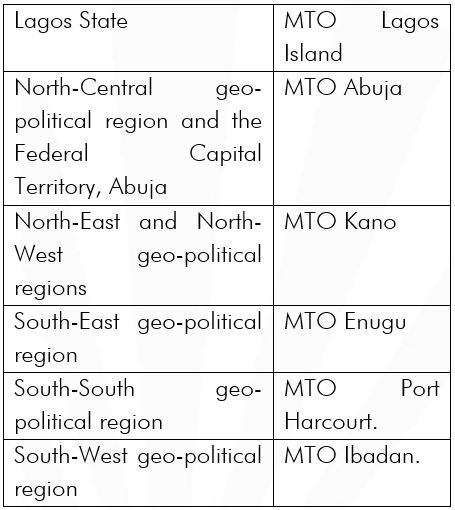

NGOs are required to register for tax, and file their annual tax returns, at the designated FIRS Medium Tax Offices ("MTOs") in their respective geopolitical regions in Nigeria, as shown in the table below:

The second Circular is titled: "Requirements for Funds, Bodies, or Institutions for Listing Under the 5th Schedule to the Companies Income Tax Act, Cap. C21 LFN 2004" (the "Listing Requirements Notice"). It provides a detailed procedure to funds, bodies, and institutions on how to be listed under the Fifth Schedule to the CITA, for the purpose of being eligible to receive tax-deductible donations from companies as permitted under the CITA. This is governed by the provisions of section 25 of the CITA and the Requirements for Funds, Bodies, or Institutions (Under the 5th Schedule to the Companies Income Tax) Regulations 2011 (the "Regulations").

An NGO requiring to be listed under the Fifth Schedule to the CITA may apply to the Minister of Finance for enlistment, through the FIRS, following the procedure and requirements for enlistment as contained in the Listing Requirements Notice. There are three categories of entities that may apply to be listed under the Fifth Schedule to the CITA, provided they satisfy the "public character" requirement in section 21(b) of the Finance Act. These categories of entities are: (i) public funds established in Nigeria; (ii) statutory bodies or institutions in Nigeria; and (iii) ecclesiastical, charitable, benevolent, educational, or scientific entities of a public character, established in Nigeria. The benefits of listing under the Fifth Schedule to the CITA is that, donations received by funds, bodies or institutions in Nigeria so listed, are tax-deductible by the person or entity making such donation, subject to the restrictions prescribed in sections 25(2) and (3) of the CITA.

Non-profit entities desiring to be listed under the Fifth Schedule to the CITA, are to apply for and obtain from the FIRS, a Tax Deductible Certificate (for a non-refundable application fee of N250,000) which will be valid for three (3) years, and renewable for a fee of N150,000 upon satisfactory performance and compliance with relevant laws, rules, and regulations.

COMMENTARY

The clarification provided by the Guidelines and Listing Requirements Notice, is expected to settle the controversies around the tax obligations of non-profits that enjoy tax exemption under relevant tax statutes. For instance, the hitherto unsettled debate on whether the additional requirement under the CGTA in relation to the application of gains by NGOs, extends to the treatment of the profits of NGOs under the CITA and PITA, has now been laid to rest. It should be noted that, whilst the profits of an NGO, which are not derived from commercial activities of the NGO, are tax-free under the CITA and PITA, the CGTA places an additional condition for exempting gains derived by an NGO from disposal of chargeable assets from tax; by providing that such gains shall be applied purely for the purposes for which the entity is established.

While we agree that tax statutes are construed strictly7 and that requirements not expressly provided in the PITA and CITA tax exemption for non-profit entities should not be read into the statutes based on some provisions in the CGTA, the clarification made by the Guidelines is in line with the combined intendment of the three tax statutes, when considered together as a whole.

Further, application of the revenue or income of a non-profit entity to any purpose other than the purpose for which the entity is established, is prohibited under the Companies and Allied Matters Act8 ("CAMA"). Most non-profit entities in Nigeria are established as companies limited by guarantee or as associations with incorporated trustees under the CAMA. Upon the dissolution of a non-profit entity, the CAMA provides that the assets of the entity shall be transferred to another entity or entities with similar objects, and shall not be distributed to its members.

Hence, non-profit entities, though generally exempt from income and capital gains tax, will have to comply with the requirements of the Guidelines to validly enjoy the granted tax exemption. In order words, NGOs must: (a) be registered in accordance with relevant law in Nigeria; (b) not derive their profits or gains from activities of a commercial nature; and (c) ensure that their profits or gains do not inure to private benefit, that is, they must not distribute or share their profits or gains in any manner whatsoever to their members or promoters. In our view, these conditions are conjunctive and not disjunctive, and therefore must be satisfied altogether before a non-profit entity can take the benefits of its tax exemption status A breach of any one of the conditions would render the profits or gains of a non-profit entity liable to income and capital gains tax.9

What constitutes "trade or business" for the purpose of determining the taxable profits or gains of non-profit entities, is not defined in the relevant tax statutes, although an attempt is made in the PITA.10 Nigerian case law has adopted a very broad and liberal construction of the term "trade or business" for tax purposes. It is settled that an isolated or causal transaction which is in the nature of trade, or of a commercial nature, is taxable, notwithstanding that it is carried on by a non-profit entity.11 Trade or business for the purpose of determining the tax liability of a non-profit entity in Nigeria is to be construed in the widest sense of the phrase, such that any activity of a commercial nature – however minute – amounts to trade or business sufficient to deprive a non-profit entity of the benefit of its exempt status under applicable tax laws.12 It has also been held that non-profit entities registered as companies limited by shares, rather than as companies limited by guarantee, will be automatically presumed by the court to be companies engaged in trade or business, and thus not entitled to the tax exemption afforded non-profit entities under the CITA and other applicable laws.13

It is not clear how donations made to public funds, statutory bodies, and other eligible entities by individuals and companies operating in the upstream oil and gas sector, will be treated. This is because, the Petroleum Profits Tax Act,14 does not provide for tax deductibility of donations made to non-profit entities. Similarly, the PITA does not provide for tax deductibility of donations made by individuals to non-profit entities, except where such donations are made for research purposes. It is hoped that a further amendment of the relevant tax laws, will address this gap.

NGOs operating in Nigeria are advised to take necessary steps to comply with provisions of the Guidelines, to avoid being liable to penalties prescribed for non-compliance under the law. It is important for non-profits to seek appropriate professional legal guidance on the procedure for listing under the Fifth Schedule to the CITA, as well as their compliance obligations under the Guidelines and applicable tax legislation.

See also:

Download PDF.

Nigeria's Tax Law for NGOs - ICNL

Reference.

Comments

Post a Comment